Document and Record Storage Business

Insurance For Document and Record Storage Business

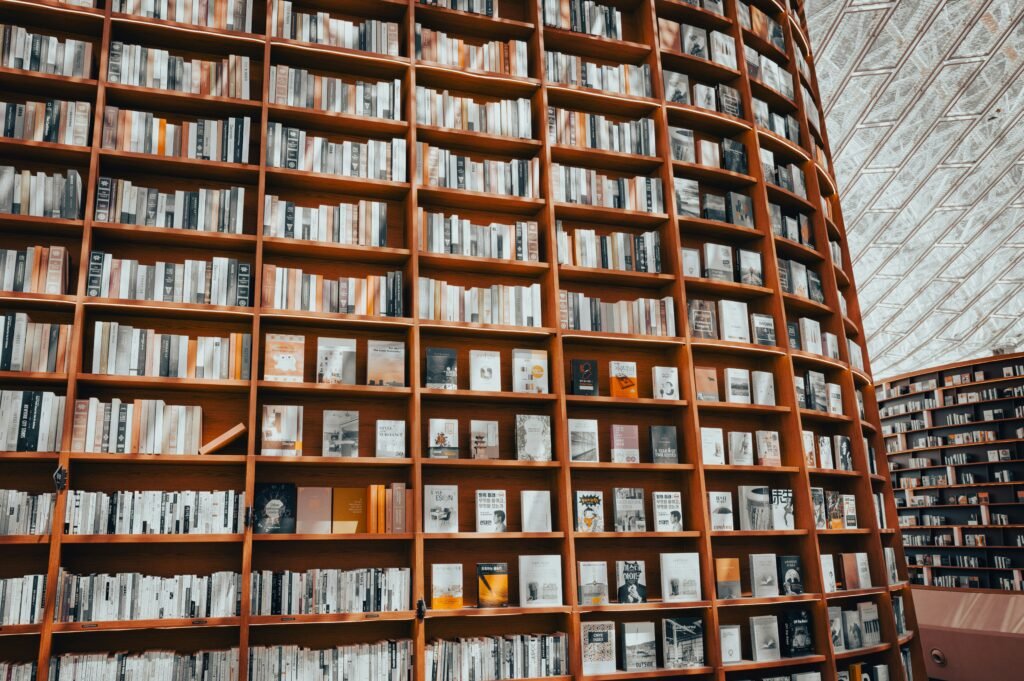

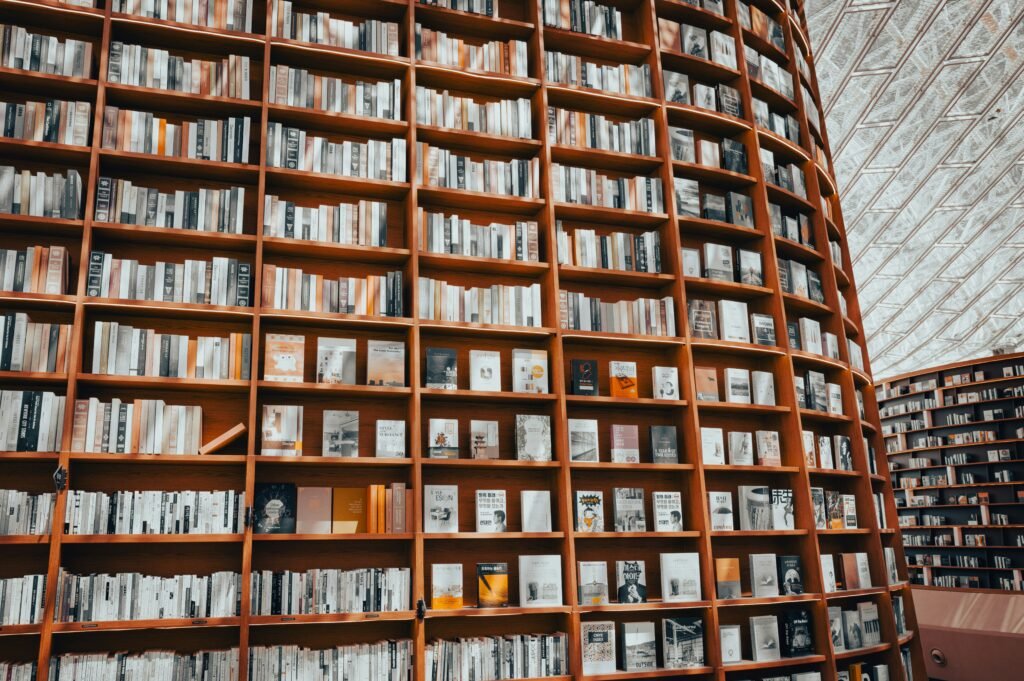

Protecting Your Document and Record Storage Facility

Running a document and record storage business means you’re trusted with highly sensitive and valuable information. From corporate archives to personal records, your clients expect their data to remain safe, secure, and accessible. With risks like fire, theft, water damage, and employee injury, having the right insurance for document storage facilities is essential to safeguard your operations and reputation.

General Liability Insurance for Document and Record Storage Business

General Liability Insurance is a fundamental safeguard for businesses that store documents and records. It covers risks like third-party bodily injury, property damage, or lawsuits arising from accidents at your facility. For instance, if a client slips and falls while visiting your storage unit, your liability coverage handles the medical and legal expenses. Without this coverage, even a single claim could financially strain your company.

To keep your facility well-protected, explore General Liability Insurance in California and learn how it can shield your business from unexpected risks. This policy is especially vital for businesses entrusted with high-value or irreplaceable documents, ensuring you can continue operations with peace of mind.

Business Owner’s Policy (BOP) for Document and Record Storage Business

A Business Owner’s Policy (BOP) combines General Liability and Commercial Property Insurance into one cost-effective package. This makes it especially valuable for document storage facilities, where you’re responsible for both physical assets and client data. With a BOP, you’re protected from risks like fire or flooding damaging stored records, while also covering legal expenses if disputes arise.

A tailored BOP also provides coverage for business interruption, meaning if your facility is temporarily shut down due to a covered loss, your lost income and operating expenses are protected. Learn more about securing a Business Owner’s Policy (BOP) in California to ensure your storage business continues running smoothly, even after setbacks.

Workers’ Compensation Insurance for Document and Record Storage Business

Your employees are the backbone of your record storage operation, handling heavy lifting, organizing archives, and ensuring client records are secure. With this comes the risk of workplace injuries, such as strains, slips, or accidents while moving boxes and files. Workers’ Compensation Insurance provides essential coverage for medical bills, rehabilitation, and lost wages when these incidents occur.

Having Workers’ Compensation Insurance in California is also a legal requirement for most employers, protecting both your staff and your business from costly claims. By investing in comprehensive workers’ comp coverage, you show clients and employees that safety and responsibility are top priorities in your facility.

FAQ

Quick Question

Because you’re responsible for sensitive records, insurance protects you from liability, property damage, and employee injury risks.

No, while it covers accidents and lawsuits, you also need property protection and Workers’ Compensation to fully safeguard your business.

Yes, with a BOP or property insurance, damage caused by covered events like fire, theft, or certain water incidents is typically included.

Yes, in California and most states, Workers’ Compensation Insurance is legally required if you employ staff.

Premiums vary based on facility size, location, and the value of stored records, but bundling policies like a BOP can reduce overall costs.

Get Free

Quote

Get your personalised moving insurance quote today with Moover Insurance – quick, easy, and tailored to your needs.